A few weeks ago, Paul Krugman wrote a lengthy

essay on the history of macroeconomic thought for the New York Times Magazine. His article prompted a

flood of commentary both pro and con; I do not propose to add to this deluge.

I do however want to take issue with one particular assumption that runs through both the original article, and through many of the responses to it (from both left and right). This assumption has to do with the relationship between rationality and bubbles.

One group of economists argues that traders are rational and markets are efficient; hence bubbles (if they do arise) are likely to be short-lived and self-correcting. Since markets are largely self-regulating, the role of government is to intervene as little as possible

1.

Another group argues that traders are often irrational and markets are often inefficient; hence bubbles may last a long time before eventually (and painfully) bursting. Since markets cannot be trusted 100%, the role of government is to intervene whenever necessary.

Some members of the interventionist crowd go further: they take the (to them, self-evident) existence of bubbles as

proof that traders are not rational.

Meanwhile, some members of the non-interventionist crowd invert this logic: they

assume the rationality of traders to argue that bubbles cannot in fact exist (“the price is always right”).

Running through all these arguments is the assumption that rational traders will not foster bubbles; indeed, that they will trade against any bubbles that they encounter.

This assumption is wrong. Ask any experienced macro hand what he would do when confronted with an incipient or actual bubble, and the answer comes pat: ride the trend. Contribute to the bubble’s expansion, don’t counter it.

Why is it rational to ride bubbles?

The first reason is the simplest: it is exceedingly difficult – bordering on the impossible – to predict when a given bubble will burst. The canonical financial bubble follows an exponential growth path; such a path is scale-invariant and self-similar, hence there is no way to tell, just from looking at a chart, whether one is closer to its beginning or its end.

Second, the pattern of gains and losses during a bubble’s expansion and subsequent collapse is typically asymmetric. Expansions tend to play out over a scale of years, while collapses often occur within a matter of weeks or months. Expansions involve steady gains gradually accumulating (and eventually exponentiating), while collapses involve sudden massive drops and large amounts of wealth wiped out in very short time spans. From a portfolio point of view, the overall effect is a wash (as indeed it should be, given that bubbles, by definition, do not involve true wealth creation). Hence a portfolio should be agnostic towards bubbles.

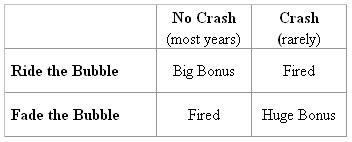

But for an individual trader the incentives are quite different. Most professional traders make an annual performance-linked bonus if they’re successful, and face firing if they’re not. Clearly, for a trader it is better to bet on a continuing expansion (and be right 9 years out of 10) than it is to bet on a crash. The payoff matrix is straightforward:

When the crash comes (as eventually it must) the trader’s portfolio will lose far more money than it would have gained in the event of no crash, but the cost to the trader is no more severe than if he had bet against the bubble and been proven wrong.

It’s not just short-term risk-reward considerations that make bubbles more likely; there’s also a long-term selection effect at work. A trader who stays contrarian throughout an expansion is likely to be out of a job by the time the crash finally comes. Rational contrarians recognize that “you have to be in it to win it”; hence they swallow their skepticism and become (or act like) true believers. Bubbles thus tend to create their own boosters, while forcing out all the naysayers. This is selection at its most insidious.

Finally, consider the case of the prescient trader who stays in the game long enough to counter-trade the bubble just before it pops. Does he profit from his acuity? In many cases, the answer is no. Trader bonuses are paid out of firm-wide compensation pools; if the rest of the firm has lost money (and remember, the rest of the firm is full of herd-followers who were riding the bubble, for all the reasons detailed above) then our hypothetical trader would not get paid. One more reason not to counter-trade the bubble (or rather, not to counter-trade your colleagues, which is much the same thing).

Notice that these arguments depend to a large extent on endogenous or even circular reasoning. Bubbles grow exponentially because everyone rides them; but one reason why people ride bubbles is because the growth is exponential. Similarly, traders conform because they fear that contrarianism, even if successful, will go unrewarded; but one reason why contrarianism goes unrewarded is because all the traders are conformists

2.

This should be no surprise. The defining characteristic of a bubble is positive feedback. Without positive feedback, incipient divergences from ‘fundamental value’ will always be counter-traded, causing reversion to the mean. And what is endogeneity (or circularity) but a positive feedback loop? The triggers may be various and even insignificant, but once a bubble gets under way, it’s very hard to pop. And despite the conventional wisdom, no rational trader would even try.

Addendum: bubbles have many progenitors. This article focuses on the incentives governing one group thereof, namely professional traders. Not everyone has exactly the same payoff profile, or is exposed to exactly the same group dynamics, as traders. Nonetheless it turns out that analogous factors are at play for almost everyone concerned in inflating a bubble. I will return to this topic – how different actors face similar structures leading to similar outcomes – in future posts.

Footnotes:# 1 This view, incidentally, provided much of the intellectual ballast for the deregulation policy followed by the Greenspan-era Fed-Treasury-SEC.

# 2 This applies to the specific case of multiple traders within a particular firm during a bubble. There are other situations in which being contrarian is profitable and also not inconsistent with trend-following; I will address such situations in future posts.